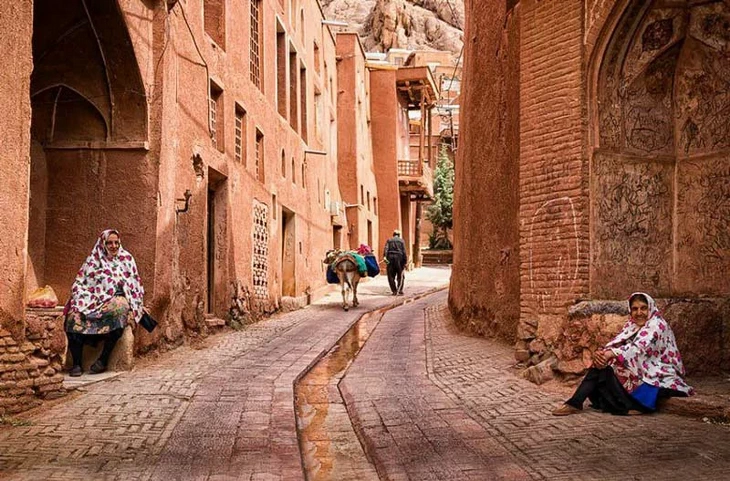

Dealing with Money in Iran

We’ve briefly talked about the services provided by Mahcard (the premium Iranian debit card) and more extensively about dealing with money in Iran in other blogs, but the subject is important enough to require its own separate article. As you already know, with Iran’s complicated international relationships and the sanctions applied against it, there are some unwanted complications implied for those who want to travel to our country. With that said people around the world are gaining a newfound appreciation for this ancient land’s history, art, and architecture, and the quarrels of governments and politicians aren’t reason enough to stop tourists from wanting to see the sights and attractions of Iran up close. But how should you deal with the obstacles hurdled at you?

Possible Solutions

With the world moving towards providing global approaches and solutions for communication, currency, and what have you, Iran is among the few countries left where those methods aimed to simplify traveling aren’t going to work in the way you expect them to. Your credit/debit card is not going to work here, so you’re left with two options: You can either exchange your local currency for Iranian Rials and carry huge amounts of cash on your person (which is certainly not ideal, not only from a security point of view but also with the complicated Rials and Toomans system), or you can acquire the services of a company like Mahcard to get yourself an Iranian debit card.

Side note: You can also carry Euros or Dollars on you, but while these currencies are accepted at most places of accommodation and some tour services, you can’t really pop into a supermarket with a 10-dollar bill and expect an easy trade-off. Also, there’s always the issue of trust when wanting to exchange your money in Iran: While a lot of people aren’t planning on scamming you, some of them are, and a few rotten apples tend to spoil the bunch.

The Benefits of Using an Iranian Debit Card

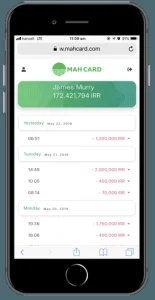

If you’re using an Iranian debit card instead of the cash alternative, you’re going to have a certain peace of mind, because you know that first of all, you can use it pretty much everywhere. and for every transaction. Secondly, you’re much less likely to be scammed, since there is a clear log of everything you have done with your card. Last but not least, if you’re using Mahcard, you can easily load money onto your card with reasonable service fees, make online transactions, and have the comfort of knowing your money is safe.

Mahcard Debit Card

Now, there are other banks and companies that offer Iranian debit cards for travelers, but the reason why we prefer Mahcard is the credibility and the trust it has gained over the years, being founded in 2017. Mahcard works with the Ayandeh Bank in Iran, so you know that in case anything goes wrong, you’re not just dealing with some anonymous online company. A debit card issued by this company comes with an initial issuance fee, and after that, you don’t have anything to pay unless you want to top off your card online. You can also do so with cash, but only if you’re in Tehran.

In any case, topping off your card online is much more convenient since you can use PayPal, Visa, MasterCard, and other major credit/debit card companies to do so. Paying a small service fee for this added convenience does not seem like such a bad idea. Another thing that will undoubtedly make for a better experience with using an Iranian debit card is the reasonable exchange rates that Mahcard uses. This is not only useful for your initial deposit and later top-offs, but it also means that if your time in Iran has ended with some balance still remaining on your card, you can get it back in your original currency, paid out in cash or to your PayPal/other services.

Ways of Acquiring a Mahcard

You can apply for a Mahcard online, and have your card issued within 3 working days and delivered to your hotel/hostel of residence in most cities of Iran. An agent of the company will meet with you to deliver your card, loaded with the money you’ve paid in deposit, and after that you’re basically good to go!

What Makes This Service Stand Out

We’ve already mentioned that Mahcard’s reputation, low/non-existent service fees, competitive exchange rates, ease of use, and security are among the reasons why it’s a head above its competitors. In case you need any more reasons to sell you on acquiring their services to get your own Iranian debit card, you can check out the FAQ on their website!

We encourage you to read our series of blogs dedicated to helping you figure out the essential parts of your trip to Iran!